/cdn.vox-cdn.com/uploads/chorus_image/image/57828235/865926158.jpg.0.jpg)

The tax bill the Senate passed Friday is a sweeping piece of legislation, transforming the US health care sector, higher education, philanthropy, and, of course, the federal tax code. It’s a major policy change that creates big winners and big losers across the country and even internationally — and fulfills a goal for Republicans who have struggled to pass their legislative agenda all year.

Here’s who winds up ahead, and who winds up behind.

Winner: corporations of every shape and size

The cornerstone of the tax bill, the change that’s permanent and enduring and that even a future Democratic administration is unlikely to fully reverse, is its reduction of the corporate income tax rate from 35 percent to 20 percent.

This fulfills a longstanding demand of corporate executives and lobbyists, who complain that the statutory corporate tax rate charged in the US is higher than in peer countries; indeed, it’s the highest in the OECD grouping of rich developed nations. Our high rate, however, is offset by copious tax breaks and the ease with which the US allows companies to move profits to tax havens overseas, which means that the effective rate US corporations pay isn’t much different from what companies in other rich countries pay. The effective tax rate paid on profits from new investments in the US was about 24 percent in 2014.

A longstanding goal of both Democratic and Republican politicians has been to bring the statutory rate down from 35 percent by closing tax breaks in the corporate code. In theory, it should be possible to get the statutory rate closer to the 24 percent effective rate that way. The Obama administration had a plan for revenue-raising corporate tax reform with a tax rate of 28 percent, though it didn’t specify many tax breaks it wanted to close to pay for that.

Republicans in Congress and the Trump administration, by contrast, have opted for a 20 percent rate, lower than the effective rate, all but ensuring that overall taxes on corporations will be lowered. They also haven’t closed many tax breaks; they continue to let businesses deduct some of the interest they pay on loans, and don’t touch the large research and development tax credit or the credit for low-income housing developers.

They make it easier for companies to move profits overseas by adopting a territorial system where profits earned abroad are taxed at a lower rate, and sometimes not taxed at all. They also offer a much lower rate for companies that decide to bring back profits currently parked overseas; this corporate tax “holiday” encourages future tax evasion by setting a precedent that evasion will be rewarded with special breaks to bring the money back.

And Republicans add a big new tax deduction for corporations by, for five years, letting companies deduct the full value of their investments. A lot of economists like this provision and think it’s good for growth. But it costs a substantial amount of money.

How do Republicans pay for all this? In the short run, they don’t, and just add $1 trillion or more to the federal debt. In the long run, they raise taxes on individuals and limit health care aid through ending Obamacare’s individual mandate. After 10 years, the bill is basically a tax hike on individuals, particularly poorer individuals getting Medicaid or insurance subsidies, to pay for corporate cuts.

And even companies that don’t pay the corporate income tax benefit. The bill is set to add a deduction (initially set at 17.5 percent, reportedly now increased to 20 percent) for pass-through income, money that company owners earn from firms like partnerships and LLCs and S corporations that are exempt from corporate taxes. Pass-through companies already face substantially lower taxes than bigger “C corporations,” which pay the corporate tax as well as individual income taxes when they return dividends to shareholders. But they’ve lobbied successfully to get an additional break as C corps see their taxes slashed.

And here’s the thing: Democrats won’t reverse all of this if they take power in the future. They’ll reverse some of it, for sure. But recall that Obama wanted a 28 percent corporate tax rate. No one wants to go back to 35 percent. Even if the bill is largely reversed, it will leave a lasting legacy in the form of a lower corporate rate, which will be tough to dislodge given Washington’s bipartisan passion for low corporate tax rates.

Loser: 13 million Americans without insurance

The Congressional Budget Office has estimated that the tax bill’s repeal of Obamacare’s individual mandate will raise about $338 billion to pay for tax cuts focused at corporations — but will, in the process, lead to 13 million fewer people having health insurance by 2027; 4 million fewer will have insurance as early as 2019, when the provision takes effect.

The most immediate effects are on people with individual market insurance, including that subsidized by Obamacare, and people on Medicaid. The CBO finds that 3 million fewer people would have individual market insurance and 1 million fewer would have Medicaid in 2019 if the mandate goes away. Five million fewer each would have Medicaid and individual market coverage in 2027; the remaining millions are people with employer-based coverage who'd lose it.

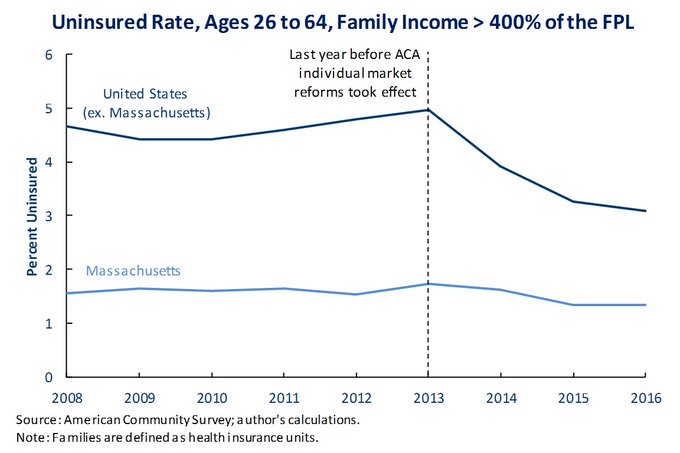

Some Republicans defending the tax bill argue that the 13 million figure is exaggerated, that the mandate can’t possibly spur that many people to sign up. But there’s empirical evidence backing up the idea that it drives a significant number of people into health insurance.

Matt Fiedler at the Brookings Institution looked at how enrollment in individual health insurance changed after the mandate took effect, focusing on Americans too rich to get Obamacare subsidies (so the only new reason they’d have to sign up is the mandate), and comparing people outside Massachusetts to those in Massachusetts, since the state already had an individual mandate. He found big increases in the share of people in this group insured outside of Massachusetts — but no similar increase in Massachusetts. That strongly suggests that the addition of the mandate made a big difference.

This has major consequences for public health. When my colleague Julia Belluz dived into the evidence on the effect of health insurance on mortality, she found two particularly compelling studies, analyzing the effects that Massachusetts’s health reform law (which was very similar in structure to Obamacare) and Medicaid expansions in three states had on death rates. Extrapolating from those studies' findings, she found that 20 million people losing health insurance translates to anywhere between 24,000 and 44,000 extra deaths per year.

Using the smaller figure to be conservative, and extending it to the 13 million people who the CBO estimates would lose coverage under this tax bill, that means 15,600 extra deaths every year.

Winner: wealthy individuals

/cdn.vox-cdn.com/uploads/chorus_asset/file/9758347/tpc_chart1.png)

According to the Tax Policy Center (whose analysis does not include the health care changes in the bill), fully 61.8 percent of the total federal tax change under the bill will go to the top 1 percent in 2027, its 10th year of implementation. They would get an average tax cut of $32,510, and the top 0.1 percent (who make at least $5.1 million a year) would get back $208,060 on average.

That’s because the wealthy disproportionately benefit from cuts to the corporate income tax, and corporate tax cuts in the bill are permanent. However, individual cuts expire at the end of 2025. Meanwhile, certain tax hikes for individuals, like a change in the inflation measure used to adjust tax brackets, are permanent. The result is a substantial across-the-board tax increase for Americans not rich enough to own stock, financing large corporate cuts that benefit the rich.

But these averages obscure important differences within income groups. Some people earning $200,000 a year will pay less in taxes in 2027. But others will pay more, which can be obscured by a finding that, say, the 80-90th percentiles as a whole will get a $340 tax cut on average.

The TPC modeled out for 2019, 2025, and 2027 what share of each group will see taxes go up and down. Here’s 2027:

/cdn.vox-cdn.com/uploads/chorus_asset/file/9758423/tpc_chart3.png)

Overall, 50.3 percent of taxpayers see their taxes go up, with an average hike of $170; but 28 percent see their taxes go down, by $1,640 on average.

These percentages vary widely between income groups. Within the middle quintile, people earning $54,700 to $93,200 a year, 65.6 percent would see their taxes go up. But only about 1.8 percent of the very richest one-thousandth of Americans would see a tax hike.

Note, again, that this doesn’t take into account the effect of cutting health care.

Republicans argue that 2025 is a better year to look at than 2027, as they say that, despite writing the bill so that individual cuts expire, they hope to make them permanent in the future. While it’s somewhat disingenuous to demand that your bill be evaluated not as it’s written, but as it might be amended at some later date, here in the interest of fairness is TPC’s 2025 projection:

/cdn.vox-cdn.com/uploads/chorus_asset/file/9758365/tpc_chart2.png)

Here, 74.1 percent of Americans get a tax cut, and the average American household in the middle quintile would get a $880 cut. But 12.2 percent of Americans would see taxes go up, with hikes concentrated in the upper middle class and among the very rich. Only 22 percent of the benefit would be concentrated in the top 1 percent (far lower than in 2027), but 63.7 percent goes to the richest fifth of Americans.

And regardless, in every year TPC modeled, the biggest percentage cuts are reserved for the top 5 percent, with the cuts increasingly concentrated among the ultrarich in 2027:

/cdn.vox-cdn.com/uploads/chorus_asset/file/9758221/picture1_24.png)

Loser: victims of drunk driving

This is a less well-known provision of the bill, but Senate Republicans are proposing slashing federal alcohol taxes across the board by about 16 percent, a cut affecting beer, wine, and liquor alike.

There is voluminous economic evidence showing that higher alcohol taxes save lives by reducing binge drinking and thus reducing deaths due to drunk driving, liver cirrhosis, alcohol-fueled assault and domestic violence, and other causes. That suggests that lower alcohol taxes, in turn, increase deaths from those causes.

Adam Looney, an economist at the Brookings Institution, uses the best estimates from the economic literature to calculate that roughly 1,550 more people will die every year from alcohol-related causes if the alcohol tax changes in the bill take effect. Of those deaths, 280 to 660 will be in motor vehicle accidents, the rest from other causes.

This is a smaller mortality figure than the one caused by repealing the individual mandate. But this is concerning nonetheless. This is one of the few pieces of federal tax legislation in recent years for which it is possible to compute a body count.

Winner: GDP growth (for now)

Fair is fair: Reasonable people can disagree about the scale of the economic growth effects that the tax bill will generate, or about their practical significance (Jason Furman, Obama’s former top economist, and former Treasury Secretary Larry Summers have been particularly adamant in arguing there’s little tax cuts can do to juice growth), but every analysis of the economic effects of the law to date agrees on the sign. The law would most likely mildly increase economic growth.

The Joint Committee on Taxation, Congress’s impartial arbiter of tax numbers, estimated that the bill would increase long-run GDP by 0.8 percent, with the boost dissipating over time. The broadly respected Penn Wharton Budget Model, which is overseen by UPenn economist and Bush administration veteran Kent Smetters, finds that GDP in 2027 would be 0.3 to 0.8 percent greater, and by 2040 would be between 0.2 percent lower and 0.5 percent greater. On the optimistic side, the right-leaning Tax Foundation finds that the bill would increase GDP by 2.7 percent over the long run, and increase middle-class incomes by 5 percent through supercharged growth.

You can argue that these numbers aren’t very significant in practice, and you’d have a fair argument. A poll by UChicago’s business school asked America’s most eminent academic economists if they agreed with the statement, “If the US enacts a tax bill similar to those currently moving through the House and Senate — and assuming no other changes in tax or spending policy — US GDP will be substantially higher a decade from now than under the status quo.” Twenty-two disagreed, and only one agreed.

But “substantial” or not, it seems likelier that the tax cut will increase GDP than decrease it in the short to medium run. In the very long run, as tax increases in the bill take effect, cuts expire, and the cost of the bill increases interest rates on federal debt, the effect becomes murkier.

Loser: charities, especially universities

/cdn.vox-cdn.com/uploads/chorus_asset/file/9785535/497403534.jpg.jpg)

The tax bill increases the standard deduction substantially, from $6,350 to $12,000 for individuals, and from $12,700 to $24,000 for couples. It also lowers individual tax rates across the board, and decreases the share of wealthy estates subject to the estate tax. All these provisions expire after eight years, but Republicans intend to make them permanent eventually.

These cuts help individual taxpayers, particularly wealthy people who’d see a lower top rate and less exposure to estate taxes. But you know who they’re bad for? Charities.

The value of the charitable tax deduction depends substantially on the standard deduction, tax rates, and the estate tax. If the standard deduction increases, that means that fewer people itemize their taxes. Fewer itemizers means fewer people able to claim the charitable tax deduction. And fewer people benefiting from the deduction means fewer people making donations to charity. There’s considerable empirical evidence to suggest that charitable donations are responsive to changes in tax policy.

Lowering tax rates for individuals also reduces charitable giving. Right now, a wealthy person who donates $1 million to charity gets back $396,000 of that in the form of lower taxes, due to the deduction and the top rate of 39.6 percent. Under the Senate’s proposed top rate of 38.5 percent, they’d get back $385,000. Still a lot — but $11,000 less. That kind of change can matter on the margin, and because rates fall across the board, a lot of families of various incomes are going to see their marginal incentive to donate fall.

And charities benefit tremendously from the estate tax, which has an unlimited charitable deduction. The more people the estate tax hits, and the higher its rate, the more inclined dying people will be to decide to donate much or all of their fortune. By increasing the estate tax’s exemption, the bill reduces those people’s incentive to bequeath their estate to charities, churches, universities, etc.

Looking at the House tax bill, the Tax Policy Center estimated that its changes would reduce charitable giving by $12.3 billion to $19.7 billion in 2018, a 4 to 6.5 percent decline in giving. That's before taking into account changes in the estate tax, and the House bill, unlike the Senate bill, didn't lower the top individual rate. So the overall effect of the Senate bill on giving is likely to be larger than that.

Universities are also singled out for particular losses under the bill. It adds a tax on university endowments, which could limit spending by wealthy colleges with large endowments like Harvard or Yale. Ideally the spending cut would be focused on administrative expenses; it could also hit scientific research or financial aid.

The House bill would also add a new tax on tuition waivers for PhD students and other students receiving such benefits, which could make getting a PhD unaffordable to many people, hampering scientific research. The Senate bill doesn’t have that provision, but its passage sends the bill to conference committee, where the House plan could be added.

Winner: Paul Ryan and Mitch McConnell

/cdn.vox-cdn.com/uploads/chorus_asset/file/9785531/871814086.jpg.jpg)

By backing Donald Trump in the 2016 election, and throughout his presidency to date, Paul Ryan, Mitch McConnell, and institutional conservatism more generally were making a calculated bet.

They found this guy distasteful. Ryan repeatedly attacked him during the campaign, especially after the Access Hollywood tape emerged. Trump isn’t like Marco Rubio or even Ted Cruz. Those guys could basically be trusted to hew to conservative orthodoxy across the board. Trump couldn’t. He was a wild card, with a wing of advisers (exemplified by Steve Bannon) who melded racism seamlessly to a chauvinist version of economic populism that ran afoul of Ryan and McConnell’s passion for entitlement and tax cuts. If you want to be less cynical, you could say that Trump’s alleged sexual assaults and ties to Russia genuinely disturbed the Republican leaders.

But for better or worse, he was the nominee. And if they stayed in his good graces, they could get a couple of crucial things done. They could confirm a conservative to replace Antonin Scalia on the Supreme Court. They could repeal Obamacare. And they could get tax reform done.

They’ve now done all three. Neil Gorsuch is already firmly ensconced in Scalia’s seat, the seat for which Obama had nominated Merrick Garland. The individual mandate is gone, unraveling much of Obamacare’s coverage expansion and setting up the entire law’s potential implosion. And the corporate tax rate is permanently lowered.

The Senate bill becoming law vindicates Ryan and McConnell’s embrace of Trump. It lets them tell a story to themselves, to their supporters, and perhaps most essentially to their donors, whereby their willingness to overlook Trump’s potential criminal conduct, his alleged sexual assaults, his ties to a hostile foreign power, was justified by getting three essential Republican priorities accomplished. He helped them do what Rubio or Cruz would’ve helped them do. It was worth the trade, worth looking the other way.

Once Trump signs the law, that dynamic might change. Maybe investigating him looks more viable, less like a distraction from must-do legislative business. Maybe a Mike Pence presidency looks more acceptable.

But probably not. Ryan and McConnell will have learned that they can use Trump to accomplish their goals. And tax reform, Obamacare repeal, and Neil Gorsuch are not the sum total of their goals. There are food stamp cuts to pass, Medicare and Social Security overhauls to attempt, deregulatory efforts across a number of domains to spearhead. If giving Trump a pass got them this much already, why not keep indulging him forever?

No comments:

Post a Comment